YOUR GATEWAY TO BUSINESS SUCCESS

Formation Of WLL Company In Bahrain

A With Limited Liability (WLL) company in Bahrain combines the asset protection and flexibility of an LLC with exclusive benefits tailored for the Gulf region. Setting up a WLL can be intricate, but our premium, end-to-end services ensure a seamless experience from start to finish

Enjoy full ownership, tax benefits, and a strategic Gulf location with our tailored support.

Fill The Form To Get Info

Our Step-by-Step WLL Company Formation Process in Bahrain

While the cost of company registration can vary widely depending on factors like license type, location, and entity size, Bahrain remains one of the most cost-effective options for business setup in the Middle East. With the advantage of multiple registration zones and flexible license types, investors can choose a setup path that aligns with their budget and long-term business goals.

1. Initial Document Preparation

We assist in gathering all required documents, such as partner passports, No Objection Certificates (NOCs) for Bahrain employees, and proof of address, so you’re ready to proceed efficiently.

2. Drafting the Memorandum of Association (MOA)

The MOA defines your company’s structure, goals, and governance. We handle drafting and notarization to ensure compliance with Bahrain’s legal standards.

3. Setting Up a Corporate Bank Account

A local corporate bank account is essential for the registration process. We support you in selecting a bank and preparing required documents, obtaining the deposit certificate needed for registration.

4. Submission to MOICT

We submit your application and supporting documents to the Ministry of Industry, Commerce, and Tourism (MOICT) for initial review and approval, ensuring a smooth start to the process.

5. Municipal Licensing and Approval

Our team manages the required approvals from the local municipality, securing your commercial license in line with Bahrain’s zoning laws.

6. Final Registration with Commercial Register (CR)

Upon approval, we complete your registration with the Bahrain Commercial Registration department, obtaining your unique CR number, which formalizes your company’s status.

Services We Offer for WLL Company Formation

Our consultants specialize in providing end-to-end support, ensuring a hassle-free experience for clients. Here’s how we help make your Bahrain business setup a reality:

1. Business Strategy Consulting

Assisting clients in formulating viable business plans tailored to Bahrain’s market landscape.

2. MOICT Representation

Handling all applications, documents, and regulatory requirements.

3. Municipality Approval and Licensing

Handling all applications, documents, and regulatory requirements.

4. Banking Assistance

Assisting in opening a corporate bank account and securing deposit certificates.

5. Legal Document Drafting

Preparing and notarizing the MOA and other essential legal documents.

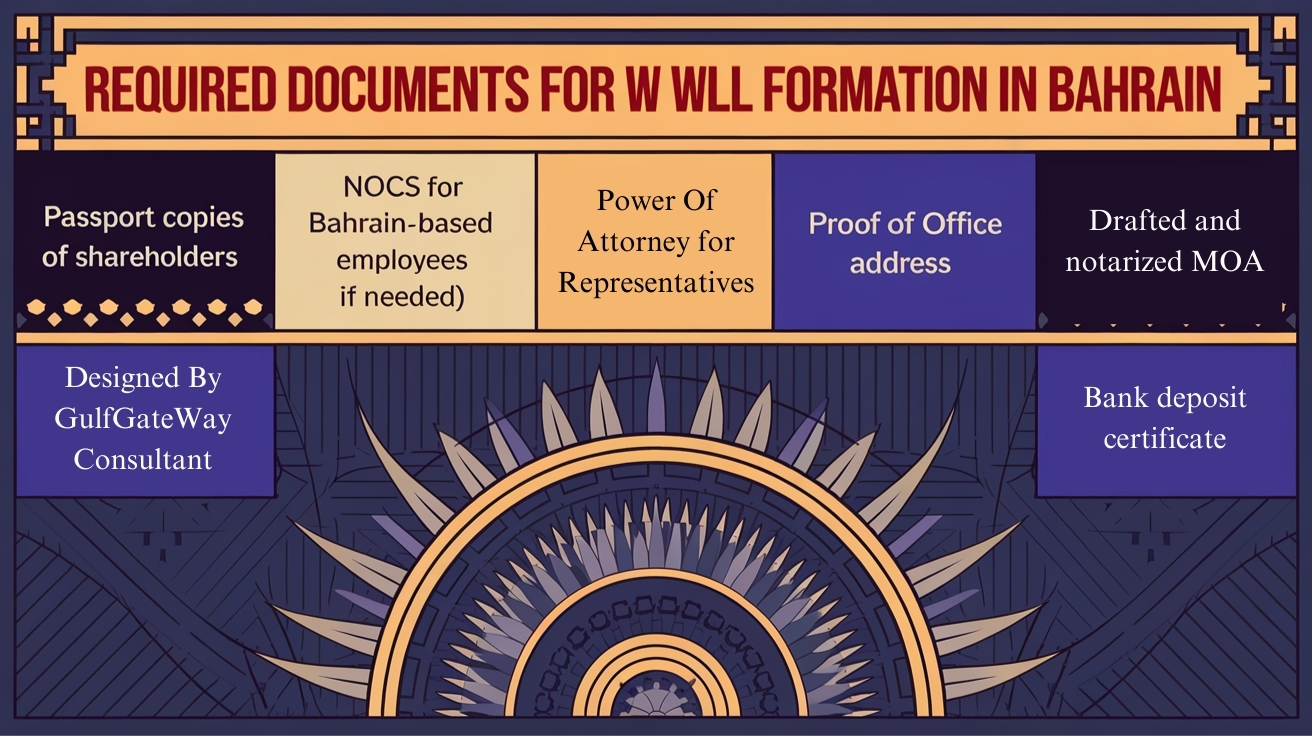

Required Documents for WLL Formation in Bahrain

To streamline the process, ensure the following documents are available and accurate:

Setting up a WLL company can be complex, but working with a trusted advisory firm makes the process far easier.

With expert guidance, you’ll ensure compliance with Bahrain’s regulations at every step, from documentation to MOICT representation. Let professionals handle the details so you can focus on growing your business.

200+

Successful Business Setups

40+

Industries Served

Why Choose Gulf Gateway Consultants for Your WLL Company Formation In Bahrain?

Bahrain offers outstanding advantages for WLL companies, and Gulf Gateway Consultants is dedicated to helping you make the most of them.

1. Personalized Solutions for Your Goals

We understand that every business is unique. Our advisors craft customized strategies that align with your objectives, setting a solid foundation for your company’s success.

2. Expertise in Bahrain’s Regulatory Environment

With deep knowledge of Bahrain’s regulations, we handle all compliance and documentation, making the process seamless and reliable.

3. Convenient, 90% Remote Process

Our efficient setup process allows you to complete almost everything remotely, saving you time and minimizing disruption.

FAQs

Frequently Asked Questions

Key Insights on Forming a WLL Company in Bahrain

Discover essential insights and strategic benefits for establishing a WLL company in Bahrain, from market advantages to regulatory clarity.

Ready to Launch Your WLL Company in Bahrain?

Our team is here to make your business setup in Bahrain seamless and straightforward. Whether you’re a local entrepreneur or an international investor, we provide expert guidance through each step of forming your WLL company, ensuring full compliance and efficiency. Partner with Gulf Gateway Consultants and start your business journey in Bahrain with confidence.

Let us handle the details while you focus on building your success in one of the Gulf’s most promising markets!